The JobMaker Hiring credit is designed as an incentive for businesses to create new jobs for younger Australians who have been impacted by COVID-19.

Note : The following information is based on the announcement in the 2020/21 Federal Budget and information provided by the Government to date. Before the JobMaker Hiring credit becomes law, legislation will need to be passed by Parliament. At the time of publication, legislation and supporting rules to support this measure had not been introduced to Parliament.

Q1: What is JobMaker hiring credit?

The JobMaker Hiring Credit is a payment to eligible employers to encourage the creation of new jobs for young people aged 16-35 (based on age at the time employment commences). The credit will be paid for 12 months, for new jobs created where employment is commenced from 7 October 2020 through until

6 October 2021. For example, if an eligible employee commences a new role on 10 October 2021, the hiring credit will be paid in respect of that employee for 12 months from the employment commencement date (ie until 9 October 2022).

Q2: How much is the hiring credit?

The rate of hiring credit depends on the age of the employee as at the date employment is commenced (ignoring the impact of birthdays that occur after commencement of employment). It will be paid

at a rate of:

- $200 per week for 16-29 year old employees, and

- $100 per week for 30-35 year old employees.

The full hiring credit will be paid in respect of eligible employees, provided the increase in the business’ payroll is at least equal to the value of the hiring credits claimed in a reporting period.

Q3: How and when is the hiring credit paid?

The credit is paid quarterly in arrears. The first payment can be claimed from 1 February 2021 for the previous quarter (for new jobs created from 7 October 2020 to 6 January 2021 which is considered to be the first reporting period).

The ATO will pay the credit directly to eligible employers. See below for more information about registration for the scheme and how to claim.

Eligible employers

Q4: Who is an eligible employer?

To be eligible, the employer must:

- have an Australian Business Number (ABN)

- be up to date with tax lodgement

- be registered for PAYG withholding

- report through Single Touch Payroll, and

- have records of paid hours worked by eligible employees.

In addition, the employer must be able to demonstrate that the role is an ‘additional’ role. See question 6 below for more information on this requirement.

Ineligible employers – Although the scheme is quite broad and available to most employers, there are some businesses that are ineligible. This includes:

- Commonwealth, state and local government agencies and any entities owned by these agencies

- Sovereign entities (excluding Australian resident entities owned by Sovereign entities, provided other eligibility rules are met)

- entities in liquidation, including those who have entered bankruptcy

- employers claiming JobKeeper, and

- employers subject to the major bank levy.

Q5: Does the employer need to satisfy a ‘turnover test’ similar to JobKeeper to demonstrate the impact of COVID?

Unlike JobKeeper, there is no turnover test applied to be eligible for the JobMaker Hiring Credit. There is also no maximum turnover threshold meaning that, provided the other eligibility rules are met, the employer will be eligible.

Q6: How is it determined that the job is an ‘additional job’ for eligibility?

As the JobMaker Hiring Credit is only available for additional jobs created from 7 October 2020, a baseline needs to be set in relation to employee headcount and payroll.

Employers must be able to demonstrate that:

- at least one additional employee has been hired since 7 October 2020 (the reference date), increasing the business’s total employee headcount since that time, and

- there has been an increase in the payroll of the business during the reporting period, when compared to the three months up to 30 September

Q7: What if my business is newly established, or didn’t have employees on 30 September 2020?

In this case, the business will not be eligible for the hiring credit for the first employee hired, because the minimum baseline headcount is one. In this scenario, businesses may be eligible for the hiring credit for the second and subsequent employees hired.

Q8: Will my business’ baseline headcount always remain the same?

No, it won’t. The baseline headcount will change during the second year of the scheme to reflect the new roles that were created in the previous 12 months. Going forward, the working credit will only be able to be claimed for new roles that exceed the new baseline. For example, if a business has a baseline headcount of 15 employees on 30 September 2020, and from this date, a business creates one new role commencing on 20 October 2020, 12 months later on 20 October 2021, the new baseline headcount will increase to 16.

Eligible employees

Q9: Who is an eligible employee?

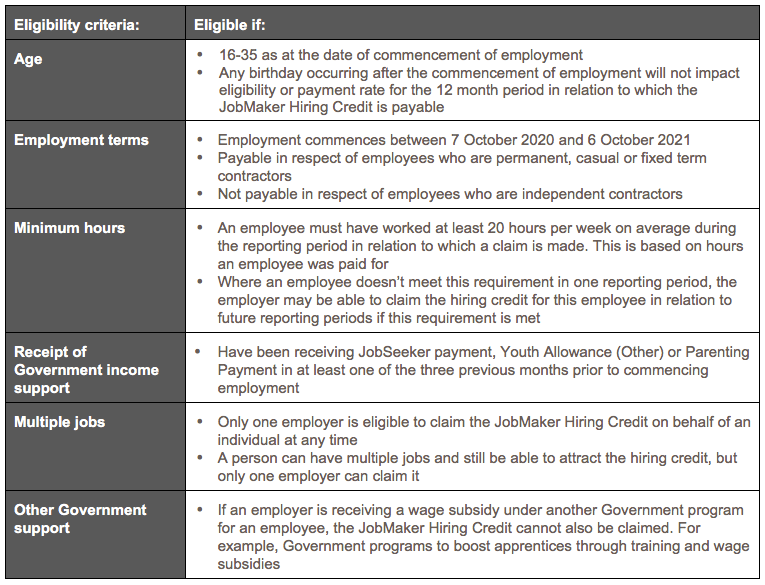

There are a number of requirements for an employee to be eligible to attract the JobMaker Hiring Credit. These are summarised in the table below –

Q10: Does the employee need to complete any paperwork?

An employer will need to ask eligible employees to complete a nomination form to declare that they meet the employee eligibility criteria. This includes a declaration that:

- they are aged 16-35 at the time of employment commencing

- they have been in receipt of Youth Allowance (Other), JobSeeker or Parenting Payment for at least one out of the three months prior to employment, and

- a JobMaker Hiring Credit nomination form has not been filled in for any other employer.

Q11: Is the JobMaker Hiring Credit payable if an employee doesn’t work for an entire reporting period?

Yes, but the credit paid will be adjusted so that it is only paid for the period of time during the reporting period that the person was employed. The amount of credit payable is determined on a daily basis. In the event that an eligible employee leaves their role, and they are replaced, the employer is able to continue claiming the hiring credit for 12 months from the date that the initial employee

commenced work.

Taxation and Centrelink

Q12: Are there any tax implications for employees?

The JobMaker Hiring Credit is a payment to employers to subsidise the cost of that role. Unlike JobKeeper, there is no requirement for the full amount of the credit to be passed on to employees. Employees must be paid in accordance with the award, industrial agreement or contract under which they are employed.

There are no specific tax consequences for employees. Employees will continue to be taxed accordingly based on their income.

Q13: How is the payment treated for social security purposes?

The JobMaker Hiring Credit is paid to employers. Employees do not need to report to Centrelink that their employer is receiving the hiring credit in relation to their role. Employees will need to continue to report any salary and wages, and other employment income to Centrelink if they are in receipt of a payment, benefit or concession card.

Application process and ongoing requirements

Q14: How do I register for the hiring credit?

Registration will be via the ATO’s online services and registration is expected to open on 7 December 2020. Registration can occur at any time, and there is no need to have been registered before a new employee is hired. However, a claim can only be made once an employer has registered.

Q15: What is the process to claim?

Claims can be submitted from 1 February 2021 in relation to any new jobs created from 7 October 2020 – 6 January 2021. As the JobMaker Hiring Credit is paid in arrears on a quarterly basis, claims submitted on this first reporting date will cover new roles commenced in the first quarterly reporting period.

Claims can be made for three months after the claiming period commences. For example, in relation to the first claiming period (7 October 2020 – 6 January 2021) that opens on 1 February 2021, claims can be submitted until the end of April 2021.

Q16: Can the hiring credit be claimed for existing employees?

No, it is only payable in relation to new roles created for eligible employees from 7 October 2020.

Q17: Can I claim the hiring credit as well as JobKeeper and other wage subsidies?

No. An employer cannot receive JobKeeper, or any other wage subsidies (such as the Supporting Apprentices and Trainees subsidy and Boosting Apprentices wage subsidy) and JobMaker Hiring Credit at the same time. Once the employer exists the JobKeeper scheme, they may then be eligible to register for the JobMaker Hiring Credit scheme and apply for a payment for future reporting periods.

Q18: Does the hiring credit need to be paid in full to employees, regardless of their hours of work, similar to JobKeeper?

No. There is no requirement to pay the hiring credit in full as salary and wages to employees in respect of whom the credit is claimed.

More information

You can visit ato.gov.au to get the latest updates on how to register and apply for the

JobMaker Hiring Credit.

You can also find more information on treasury.gov.au, including a range of Fact Sheets.

Next steps

To find out more about these are any other issues or concerns you may have, give us a call.

Please contact Integrity One if we can assist you with this or any other business or financial matter.

Phone: (03) 9723 0522

Suite 2, 1 Railway Crescent

Croydon, Victoria 3136

Email: integrityone@iplan.com.au

This information is of a general nature and does not take into consideration anyone’s individual circumstances or objectives. Financial Planning activities only are provided by Integrity One Planning Services Pty Ltd as a Corporate Authorised Representative No. 315000 of Integrity Financial Planners Pty Ltd ABN 71 069 537 855 AFSL 225051. Integrity One Planning Services Pty Ltd and Integrity One Accounting and Business Advisory Services Pty Ltd are not liable for any financial loss resulting from decisions made based on this information. Please consult your adviser, finance specialist, broker, and/or accountant before making decisions using this information.