A mortgage is a long-term commitment, one in which many people enter with a ‘set and forget’ mentality. Most loans are around 30 years – a long time in which many things can change, not just in your personal circumstances but in the financial world, seeing the introduction of new loan products and fluctuations in interest rates.

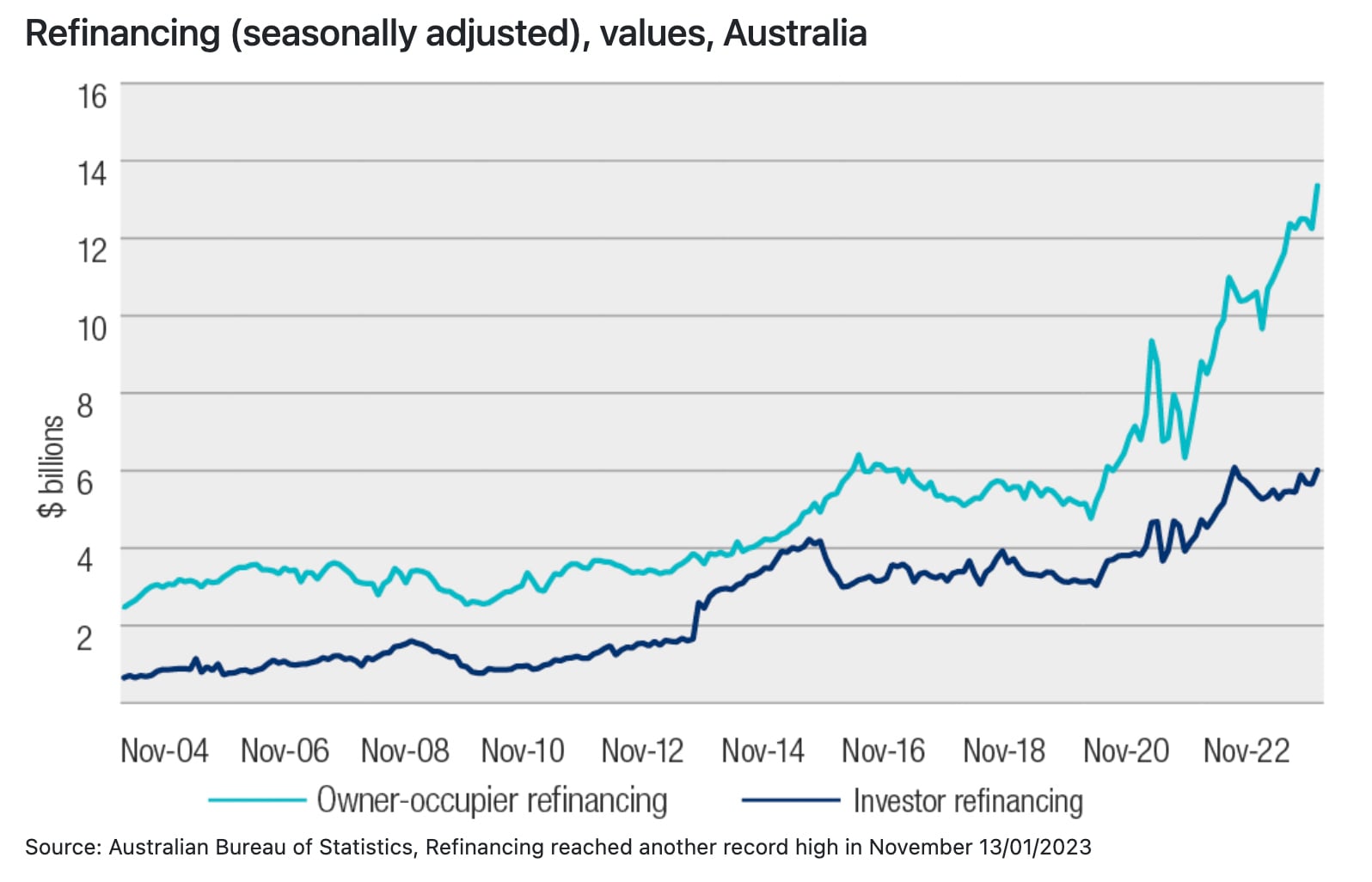

If you haven’t reviewed your loan for a while, now is a good time to consider whether it still suits your circumstances or whether you’re better off making some changes. It’s what many Aussies are doing, with the ABS reporting the value of owner-occupier refinancing of $13.4 billion last November.i

Reviewing your loan

It is a good idea to review your loan annually and there’s no better time than the present.

While this can seem like an arduous task, it doesn’t need to be complicated. Read back over your loan’s terms as a starting point. To ensure you’re receiving the best interest rate for your loan – and whether your loan is still fit for purpose – ask yourself a few things:

- Has there been a change in your employment status?

- Has there been a change in your family situation?

- Have your financial goals changed?

- Are there pressing matters that need financing (i.e. renovations, needing a new car, etc)?

- Are you wanting to invest or change your existing investments?

Knowing where you are standing financially can help you then decide whether it’s worth refinancing and chasing a better interest rate, or whether your existing mortgage is still working for you.

Types of refinance loans

There’s not just one type of refinancing, but many different types of refinance loans, including:

Rate-and-term refinance loan

This is where you replace your loan with a new loan that is the same amount, but at a changed interest rate and/or term. This is the most common refinancing option and often what people think of when it comes to refinancing.

Cash-out/cash-in refinance

A cash-out refinance loan enables you to access the equity in your home by taking out a new loan with a higher loan balance than your existing loan.

A cash-in refinance loan has you lowering your overall loan amount by contributing a lump sum – this is done by taking out a new loan less than your old loan, paying out the difference to close your old loan.

Fixing your interest rate

As opposed to a variable rate, a fixed loan guarantees a locked interest rate for a period of time (usually between 1-5 years). This is a popular option during a time of rate hikes. However, it can come with drawbacks such as not being able to take advantage of any rate cuts.

Split loans

As its name suggests, a split loan allows you to split your loan into multiple parts with different interest rates and terms. For instance, you could have part of your loan at a variable interest rate and another part as a variable rate.

Consolidation refinance

This is where you combine all your various debts into the one debt (including credit cards, car loans, etc) and therefore one repayment. This can make your debts easier to manage but can mean your short terms debts are stretched over the life of your new home loan.

Things to keep in mind

While (generally speaking) the goal of refinancing is to save money, there are a few considerations to be aware of, so you don’t end up paying more in your quest to save.

Refinancing can impact your credit rating, causing it to drop. However, it’s worth keeping in mind that this dip is short-term and shouldn’t have too big an effect on your credit score in the future.

Another thing to be mindful of is that you may need to pay Lender Mortgage Insurance (LMI) again. As LMI protects lenders, your original LMI payment won’t cover a new lender, which is why you can expect to pay this again. For most borrowers, you’ll need 20% of the property’s current value to avoid paying LMI again, keep in mind the value of your property may have changed since you first took out your loan. You might also need to pay LMI even if you stick with the same lender, but you’ll likely be given a discount.

There are also costs related to refinancing, such as application fees, discharge/break fees and valuation fees. Some lenders waive these costs or offer a discount, so be sure to ask what you will be expected to pay and see what you can negotiate.

You may also find that your bid for refinancing is rejected if you have accumulated too much debt or if your living expenses are now too high. Changes to your loan could also stretch out the repayment period, leading you to pay more in the long run.

Keeping on friendly terms with your mortgage

Whether you decide to refinance or stick with your current loan, by refamiliarising yourself with the conditions of your loan and assessing your financial situation, you’ll be better placed than if you ‘set and forget’.

Set a reminder to do this once a year – it can be easier to remember come the end of the financial year or the start or end of the calendar year.

You don’t have to go through the process alone. Give us a call on 039723 0522 to discuss your existing loan and circumstances and to chat about your future financial goals.