Overview

The 2020 Budget is all about jobs, jobs and spending to make more jobs. We already have JobSeeker and JobKeeper, and now we have JobMaker and JobTrainer. Each announcement the Treasurer made was translated into jobs. Tax cuts for 11 million taxpayers equals 50,000 new jobs; expanding the instant asset write-off and the carryback of current losses is another 50,000 jobs. Bringing forward the Stage 2 personal income tax cuts were the order of the day, and there will be no increases in tax in order to pay for spending. So unlike other economic downturns, there will be no deficits tax on high-income earners. One key theme throughout the Budget is that the Government is keen to improve outcomes for young people. We know this recession has hit young people hard and many have taken early release of their super.

The announcements in this update are proposals unless stated otherwise. These proposals need to successfully pass through Parliament before becoming law and may be subject to change during this process.

What you need to know

- The Budget is forecast to result in a record deficit peaking at $966 billion (44% of GDP) in 2024. However, thanks to record low interest rates, this comes with only a minimal increase in interest payments.

- Jobs are the Government’s primary focus — creating jobs and keeping jobs, with the introduction of the JobMaker plan (including a $100-$200 per week hiring credit for eligible employees/employers and reimbursement of up to 50% of an apprentice’s training) and the JobTrainer fund.

- Tax cuts will play a major role and, unlike other economic downturns, there will be no deficits tax on high income earners. Stage 2 personal income tax cuts are to be brought forward 2 years, backdated to 1 July 2020, with tax savings for around 7 million Australians of $2,000 or more.

- Business Owners will be able to carry back tax losses from the 2019/20, 2020/21 and 2021/22 financial years to offset previously taxed profits in the 2018/19 or later financial years. This, coupled with the Instant Asset Write-off provisions and expanded access to tax concessions for small business, is calculated to generate spending and create jobs.

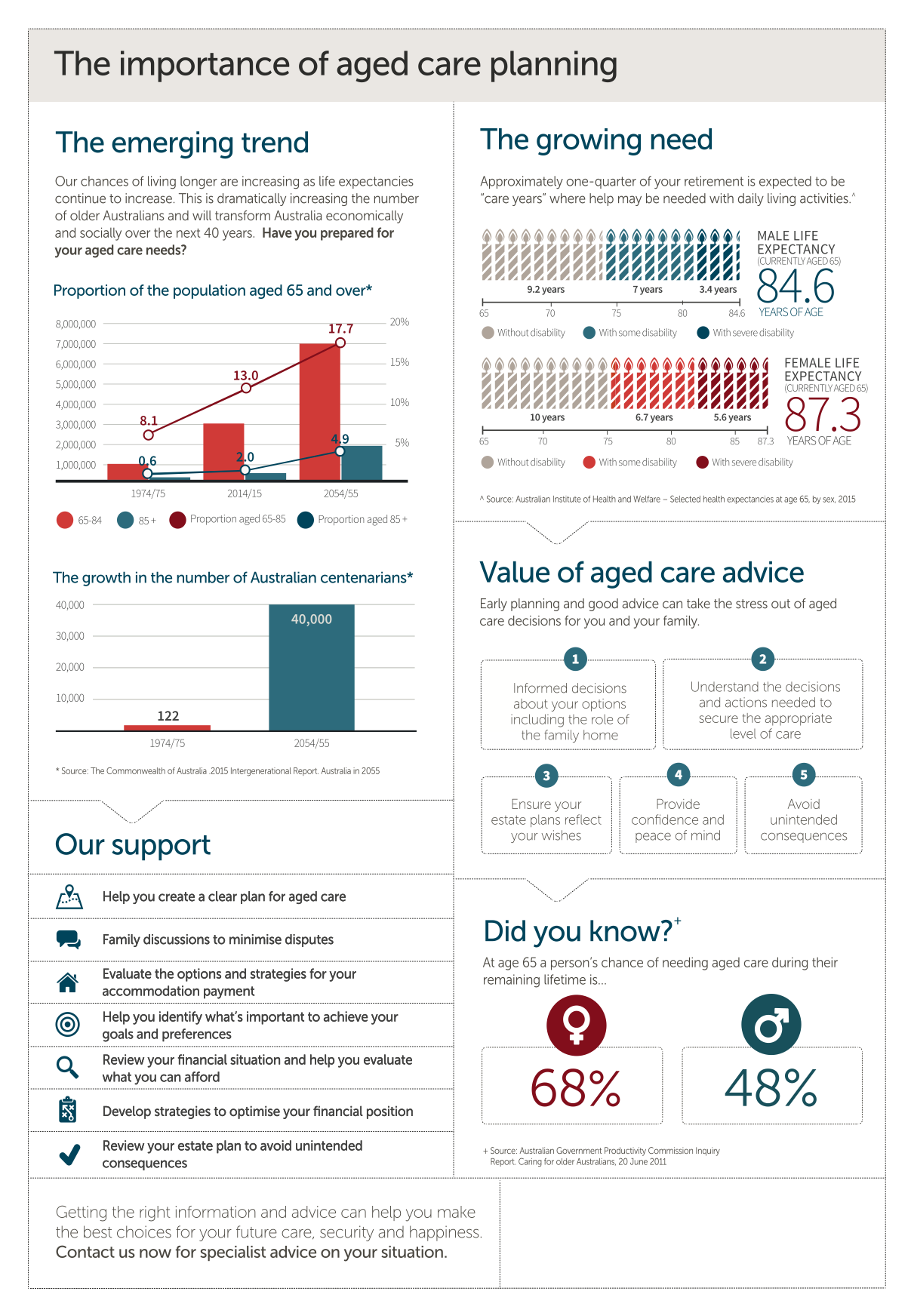

- Aged care gets a boost with 23,000 additional home care packages. Great news for the 100,000 Australians on the waiting list for these packages.

- Superannuation measures called ‘Your Future, Your Super’ include a stronger focus on reducing fees and costs by increasing transparency and reducing the incidence of individuals with multiple super funds. > Social security — aged pensioners, veterans and eligible concession cardholders will get $250 this year and another $250 early in 2021. However, there is no mention of extending JobSeeker.

Tax

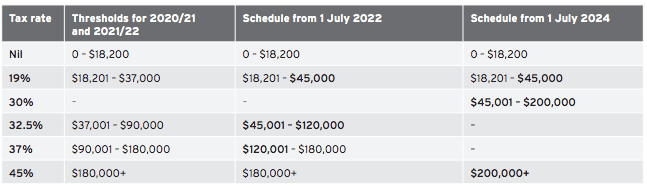

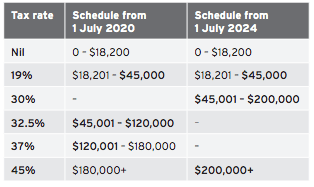

Bringing forward income tax cuts From 1 July 2020, two years earlier than previously legislated, the Stage 2 low income tax offset (LITO) and the thresholds for the 19% and 32.5% personal income tax brackets are proposed to increase. Stage 3 of the Personal Income Tax Plan remains unchanged and commences in 2024/25 as legislated.

Current tax schedules

Proposed tax schedules

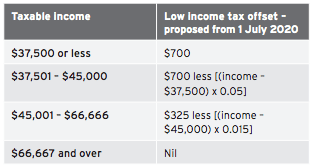

Tax offsets – 1 July 2020

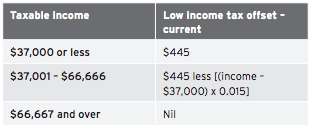

The LITO will increase from $445 to $700 from 1 July 2020. The Government has not brought forward all the changes as per Stage 2 of the tax plan. The low to middle-income tax offset (LMITO) will be retained in the 2020/21 financial year. The Government does not intend on retaining LMITO in the 2021/22 financial year. Under current legislation, it is set to end in the 2022/23 financial year.

Current low-income tax offset phase-out.

Proposed low income offset tax phase-out

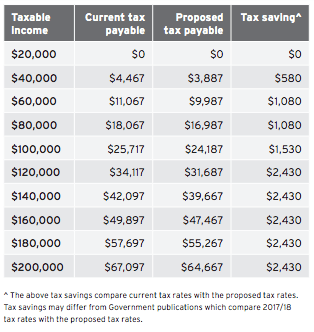

The amount of tax savings

The proposed bring-forward of the personal income tax thresholds, rates and tax offsets create the following future tax savings.

Carry back tax losses

Eligible companies can carry back tax losses from the 2019/20, 2020/21 and 2021/22 financial years to offset previously taxed profits in the 2018/19 or later financial years. This will generate a refundable tax offset in the year in which the loss is made.

Corporate tax entities with an aggregated turnover of less than $5 billion are eligible.

The amount that is carried back cannot exceed the earlier taxed profits and the carryback amount cannot generate a franking account deficit.

Full deduction for capital asset expenditure (‘Instant asset write-off’)

Businesses with an aggregated turnover of less than $5 billion can deduct the full cost of eligible capital assets acquired from 6 October 2020 that are first used or installed by 30 June 2022.

Businesses with an aggregated annual turnover of less than $10 million can deduct the balance of their simplified depreciation pool at the end of the income year while full expensing applies. The provisions which prevent small businesses from re-entering the simplified depreciation regime for five years if they opt-out will continue to be suspended.

Capital gains tax exemption for granny flat arrangements

From 1 July 2021 a capital gains tax (CGT) exemption will be introduced for formal, written granny flat arrangements that are created, varied or terminated. This will encourage elderly Australians to enter formal written arrangements which provide them protection in the event of a family or relationship breakdown and reduce the risk of financial abuse.

Medicare levy thresholds

The Medicare levy thresholds have been increased for the 2019/20 financial year.

Social security and aged care

$250 economic support payments

Two tax-free economic support payments will be paid to aged pensioners, veterans and eligible concession card holders – one payment in November 2020 and the other in early 2021.

Aged care support for older Australians

From 2020/21 the Government will provide 23,000 additional home care packages across all package levels.

Superannuation — Your Future, Your Super

Fund stapling

Under this proposal, effective from 1 July 2021, once an employee has a super fund and they change jobs, their new employer will contribute to their existing fund. Employees will however be able to advise their employer to make contributions to a different fund if they wish.

What’s next?

Most changes must be legislated and passed through Parliament before they apply. If you think you may be impacted by some of the Budget’s proposed changes, you should consider seeking professional advice. A financial adviser can give you a clear understanding of where you stand and how you can manage your cash flow, super and investments in light of proposed changes.

If any of these proposals raise questions, concerns or opportunities for you, please contact us.

Please contact Integrity One if we can assist you with this or any other financial matter.

Phone: (03) 9723 0522

Suite 2, 1 Railway Crescent

Croydon, Victoria 3136

Email: integrityone@iplan.com.au

This information is of a general nature and does not take into consideration anyone’s individual circumstances or objectives. Financial Planning activities only are provided by Integrity One Planning Services Pty Ltd as a Corporate Authorised Representative No. 315000 of Integrity Financial Planners Pty Ltd ABN 71 069 537 855 AFSL 225051. Integrity One Planning Services Pty Ltd and Integrity One Accounting and Business Advisory Services Pty Ltd are not liable for any financial loss resulting from decisions made based on this information. Please consult your adviser, finance specialist, broker, and/or accountant before making decisions using this information.