Fixed term rates have never been lower in Australia but with some lenders starting to move fixed rates and further changes on the horizon, is it time to have a look around to ensure you are getting the best deal?

Fixed rate loans have provided the lowest rates in the market for some time, with the official cash rate stable at an all-time low and lenders setting their variable rates essentially betting that the cash rate will remain low.

While the Reserve Bank of Australia (RBA) is still currently anticipated to keep the cash rate low until 2024, other forces including concerns about inflation and changing lending conditions are impacting lenders’ decisions about fixed rates.

So now that rates are again on the move – is it time for you to make a change? Here’s what you need to know about what’s happening to help you decide whether or not to fix your rate.

Current environment for rates

Interest rates set by lenders are independent of, although strongly influenced by, the cash rate set by the RBA. The cash rate was reduced to 0.1% in November 2020 – down from the previous record low of 0.25% and most banks passed on the cut by correspondingly reducing their rates.

These low rates have boosted Australia’s property market, with over 100,000 first home buyers buying property since the start of the pandemic. [1]

Current low interest rates have also spurred existing mortgage holders to review their arrangements. If you’re looking to refinance, you’re joining a growing number of Aussies doing so – 1.5 million according to a recent realestate.com.au survey, with the most common motivator being competitive rates, followed by wanting to consolidate debts or unlock equity. And 45% of new lending is occurring at fixed rates, reports Commbank – this is usually around the 15% mark, so it’s a notable increase.[2]

Why banks might shift rates

Despite the RBA stating they don’t intend to raise the official cash rate until 2024, some lenders have started to increase their longer-term fixed interest rates.

Concerns about inflation are having an impact on fixed rates. There has been conjecture that the RBA may be forced to increase their rates earlier than 2024 to put the brakes on inflation as the economy recovers from the COVID induced recession.

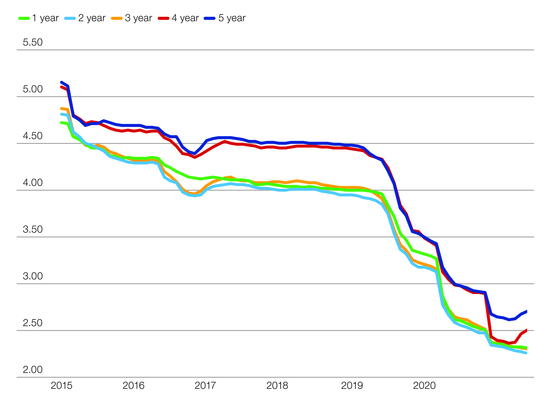

Changes to lending conditions are also contributing to recent rate rises. Lenders have been able to access money at very low interest rates through the RBA’s term funding facility, which was put in place to mitigate the impact of the coronavirus crisis. However this expired on June 30.[3] And with bond yields on 4-, 5- and 10-year fixed rates increasing, there is pressure on lenders to increase longer-term rates.

Money website Mozo recently reported that at least 25 out of 99 lenders have increased their fixed rates since January, the majority being for 4- or 5-year terms.[4] Some of the larger banks that have increased interest rates include Westpac, Commbank, NAB and UBank.

Is it worth fixing your rate?

Despite some lenders beginning to lift some fixed rates, it can still pay to look around for lower rates. Refinancing may put you in a better financial position and fixed rates could be the way to go, but it’s worth being mindful that if you need to break a fixed loan early, this could prove costly.

And even with record low rates, always be aware of the possibility that rates can drop, in which case you could be spending more. Fixed rate loans also tend to be more restrictive than variable as you won’t be able to make additional repayments, or if you are, they will be capped. They also tend to have fewer features so you may not be able to link to an offset account or redraw funds.

Should you want out, you will have to pay a ‘break fee’, and this doesn’t tend to come cheap. Savings.com.au reported break fees from a few thousand to much more, so this is something to keep in mind. While fixed rates are less flexible than variable, it could be argued that there has been no safer time to choose a fixed rate than now, so you’re less likely to want to get out of the loan.

If you have an existing loan, it’s always a good idea to reassess your rates and check that the type of loan you have in place is the best match for your circumstances. And for prospective homeowners, it is important to get advice on what loan is most appropriate for you before signing on the dotted line. There are a lot of things to take into consideration beyond getting the best rate so reach out today to find out more.

Fixed rate home loans

Average 2 year fixed rate for owner occupiers – June 2021

Average Fixed Home Loan Rates at a $400,000 loan amount, 80% loan-to-value ratio, owner-occupier, principal and interest, from the mozo.com.au database. Source: Mozo

If you’d like help or more information give us call.

[2] https://www.savings.com.au/home-loans/term-funding-facility-ending-june

[4] https://www.savings.com.au/home-loans/the-potential-35-000-cost-of-breaking-a-fixed-home-loan

Suite 2, 1 Railway Crescent

Croydon, Victoria 3136

Telephone: 03 9723 0522

Email: integrityone@iplan.com.au

Nicholas Berry Credit Representative Number 472439 is a Credit Representative of Integrity Finance (Aust) Pty Ltd – Australian Credit Licence 392184.

This information is of a general nature and does not take into consideration anyone’s individual circumstances or objectives. Financial Planning activities only are provided by Integrity One Planning Services Pty Ltd as a Corporate Authorised Representative No. 315000 of Integrity Financial Planners Pty Ltd ABN 71 069 537 855 AFSL 225051. Integrity One Planning Services Pty Ltd and Integrity One Accounting and Business Advisory Services Pty Ltd are not liable for any financial loss resulting from decisions made based on this information. Please consult your adviser, finance specialist, broker, and/or accountant before making decisions using this information.