Transition to retirement

If you’re unsure whether you will enjoy retirement or find enough to do to fill your days, it can make sense to ease into it by cutting back your working hours. One way of making this work financially is to start a transition to retirement (TTR) pension with some of your super.

Case study

Ellie, a teacher, has just turned 60. She wants to reduce her workload to three days a week so she can explore other interests and gradually ease into retirement. Her salary will drop but if she starts a TTR pension she can top up her income with regular monthly withdrawals.

Most super funds offer TTR pensions, or you can start one from your self-managed super fund (SMSF). You decide how much to transfer into a TTR pension account, but there are some rules:

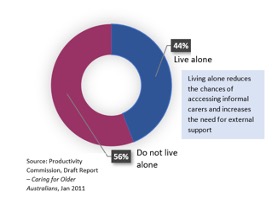

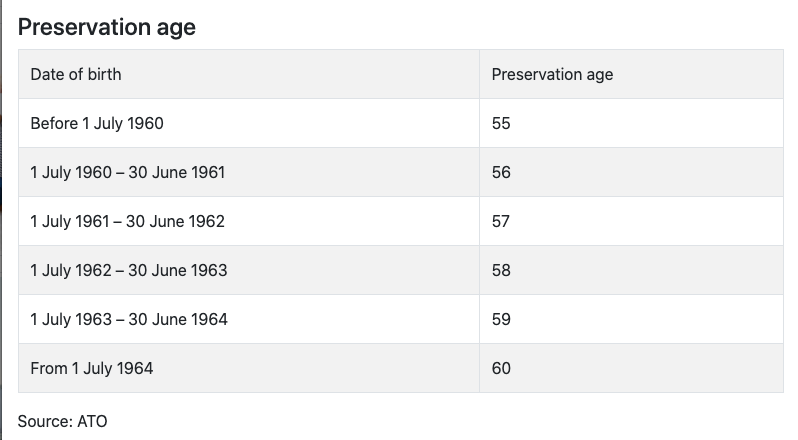

- You must have reached your preservation age

- Money can only be withdrawn as an income stream, not a lump sum

- There is a minimum annual withdrawal amount, for example, 4% of your TTR account balance (2% until June 2022) if you are aged 55-64

- The maximum annual withdrawal is 10% of your TTR account balance

- Income is tax-free if you are aged 60 or older; if you’re 55-59 you may pay tax on the TTR income, but you receive a tax offset of 15%.

One of the benefits of this strategy is that while you continue working you will receive compulsory Super Guarantee payments from your employer. A downside is that you will potentially have less super in total when you finally retire.

Retirement is no longer a fixed date in time, with far more flexibility to mix work and play as you make the transition. If you would like to discuss your retirement options and how to finance them, give us a call.

Suite 2, 1 Railway Crescent

Croydon, Victoria 3136

Email: integrityone@iplan.com.au

Telephone: 03 9723 0522

This information is of a general nature and does not take into consideration anyone’s individual circumstances or objectives. Financial Planning activities only are provided by Integrity One Planning Services Pty Ltd as a Corporate Authorised Representative No. 315000 of Integrity Financial Planners Pty Ltd ABN 71 069 537 855 AFSL 225051. Integrity One Planning Services Pty Ltd and Integrity One Accounting and Business Advisory Services Pty Ltd are not liable for any financial loss resulting from decisions made based on this information. Please consult your adviser, finance specialist, broker, and/or accountant before making decisions using this information.