Suite 2, 1 Railway Crescent

Croydon, Victoria 3136

Telephone : 03 9723 0522

Email: integrityone@iplan.com.au

Your Complete Financial Solution

Property investors will tell you that succeeding in real estate is all about timing. Just like shares, buying at the bottom and selling at the top is easier said than done.

Unless you have a crystal ball, there really is no clear-cut way to know exactly when the property market is at its peak or trough.

Whether you’re an investor, or a homebuyer, the next best thing to a time machine is research and due diligence.

While many experts agree that “time” is a popular buzz word when it comes to real estate, savvy buyers who look at the big picture acknowledge that it’s more about “time in the market” rather than “timing the market”.

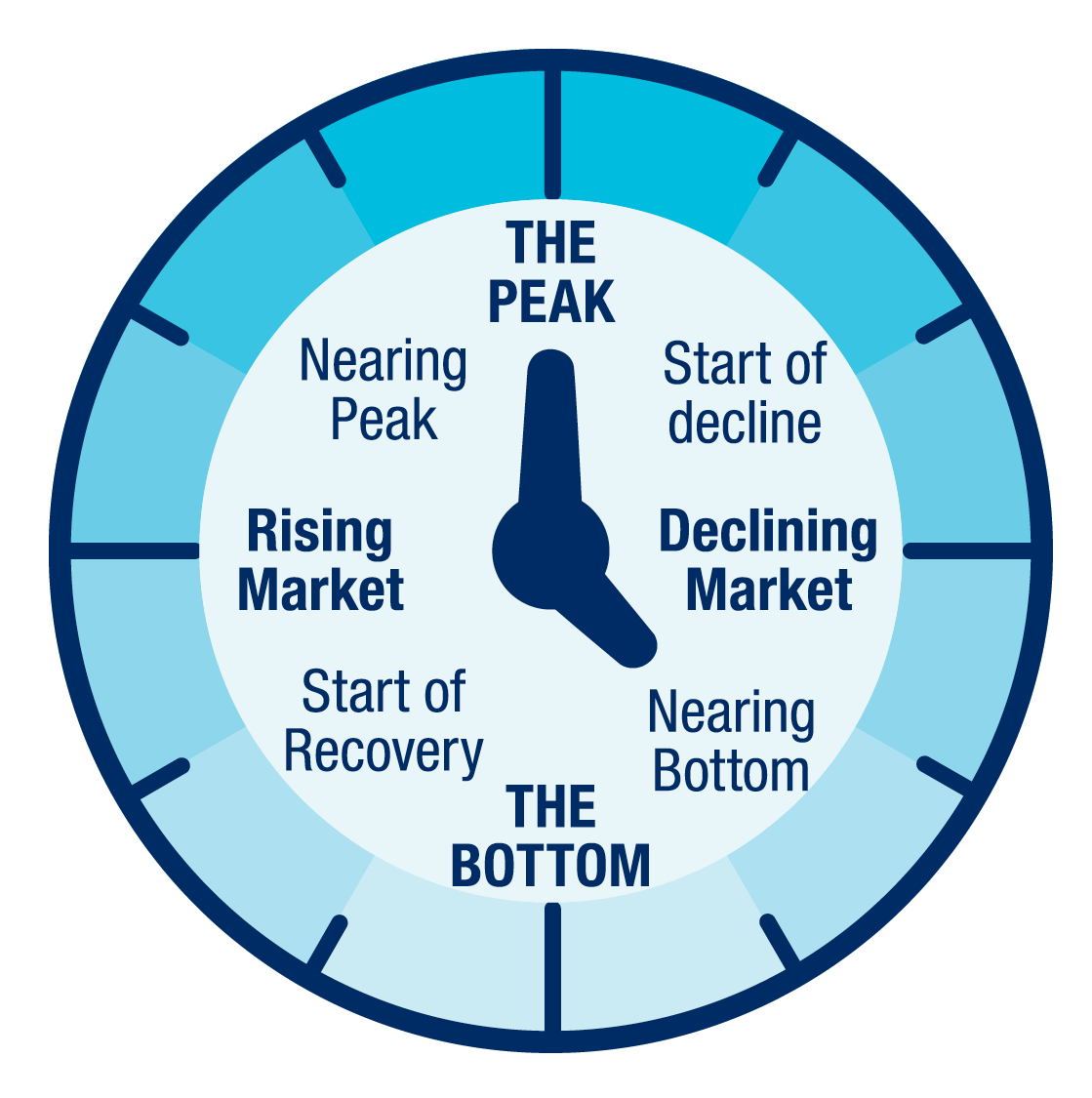

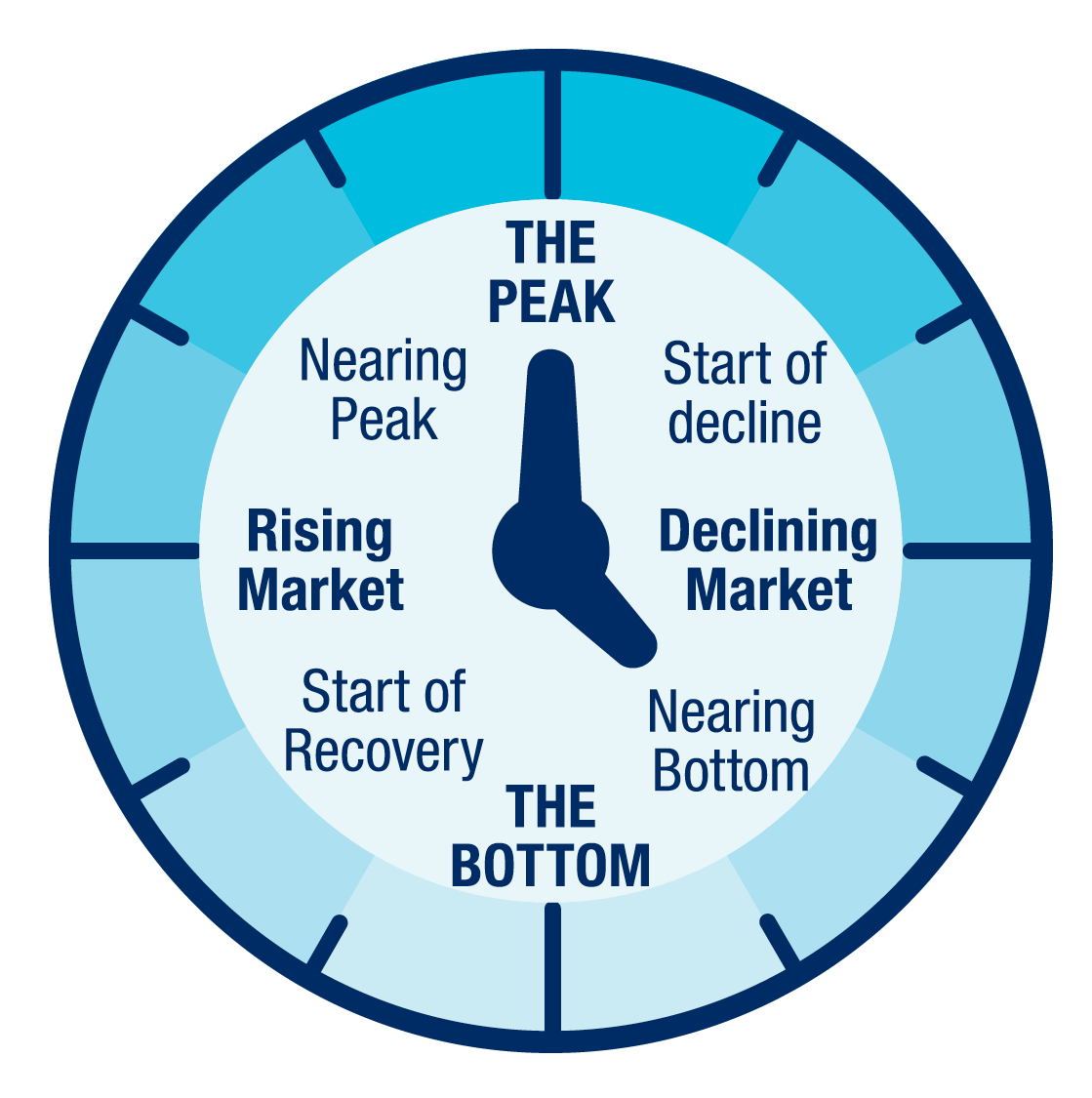

Everyone understands the principles of a clock, so some real estate analysts use this analogy to explain typical market cycles. If you were to think about an analogue clock, the hands move around the face in a clockwise direction representing where local markets are at, at any one point in time.

While the idea of a property clock is logical, life rarely is. So, the notion of a top and a bottom should be taken at face value.

The media, economists, and property experts, talk about the performance of major capitals, sometimes breaking them down into “house” and “unit” markets. They might also refer to “regional” or “rest of state” figures which effectively lumps hundreds of regional cities, towns and villages into one collective data dump.

Cities and towns might be heading one way as a whole, but dig deeper and some suburbs within those locations – and even streets or property types in those suburbs – can be running their own individual races.

This is why sellers, and buyers, should narrow their research to fit their own personal circumstances. The big picture is great for background knowledge, but knowing exactly what is happening where you plan to buy or sell is more relevant.

Remember, what keeps a particular property’s value ticking – or not ticking – comes down to the laws of supply and demand.

During the pandemic, there was a rush of people wanting to get out of the cramped quarters in our biggest cities and choosing to move to regional areas with more space and tranquility as they worked from home.

Interest rates were at record lows so people borrowed willingly to be able to secure their dream property. As a result, inner city apartments were out, bigger suburban (or country) homes were in and therefore houses and regional properties boomed.

By the beginning of 2022, the tables started turning and many locations (although not all) came off the “12 o’clock” spot and began to move clockwise, transitioning away from their market peak. Houses started to become unaffordable for many and in May 2022 interest rates started to increase so swiftly, the desire (and the ability) to pay top dollar for a property stopped.

Apartments (even inner-city ones) gradually started coming back into favour and less demand for high-priced houses saw values slip. But whether anywhere in the property market has reached the “6 o’clock bottom” is yet to be determined. Unfortunately, putting a pin in exactly when values hit a trough can often only been declared once the moment has passed.

Australia is a huge country with a diverse property market and varying cycle. Although, as a population we might experience the same external economic factors – such as inflation pressures and multiple interest rate rises – how each of them impact each corner of the country, can vary greatly.

Not even the most respected experts know exactly how long each cycle will be or the extent of the rises and falls. For example, when Covid hit many economists were signalling a property market crash – they couldn’t have been more wrong.

So, instead of having tunnel vision for timing the market, sophisticated property investors turn their attention to buying quality real estate in desirable locations that are traditionally more likely to hold their value and increase over time.

“Time” can also refer to the right time for you as a buyer because the best moment to dive into potentially the largest asset of your life is when you have your financial ducks in a row.

Experts are predicting that the market will continue to fall for the next few months, however, high-end properties in some areas have been bucking the trend and holding their value and continuing to sell quite well.

Economists are anticipating more cash rate hikes in 2023, with the possibility of rate cuts commencing in 2024 once inflation has stabilised.

While inflation is a concern for the RBA and given that there are still talks of a recession on the horizon, economic uncertainty will continue to affect buyer’s and seller’s confidence.

Whether you’re an investor or a homebuyer, holding out to buy at the bottom means you risk missing out on time in the market because as history has shown us – the longer you hold a home, the more valuable it may become.

To talk about the right time for you to make your next step onto the property ladder, speak to us today.

Suite 2, 1 Railway Crescent

Croydon, Victoria 3136

Telephone : 03 9723 0522

Email: integrityone@iplan.com.au

Stay up to date with what’s happened in the Australian economy and markets over the past month.

China’s plans to kickstart its economy after the pandemic shutdown have been dominating the news this month and will have worldwide implications, not the least for Australia.

Australian shares were up nearly 8% in January while US stocks climbed by about 5% but the markets are nervously waiting for expected increases in interest rates by major central banks this month to help curb inflation.

Click here for our February update video.

Please get in touch on 03 9723 0522 if you’d like assistance with your personal financial situation.

Suite 2, 1 Railway Crescent

Croydon, Victoria 3136

Email: integrityone@iplan.com.au

Telephone : 03 9723 0522

After 11 years with Integrity One Maddie has decided to focus her attention on her nursing career.

Maddie, on behalf of everyone at Integrity One (past and present) and our clients we wish you all the best and thank you for your many years of superb service, as well as your support & friendship!

Suite 2, 1 Railway Crescent

Croydon, Victoria 3136

Email: integrityone@iplan.com.au

Telephone: 03 9723 0522

This information is of a general nature and does not take into consideration anyone’s individual circumstances or objectives. Financial Planning activities only are provided by Integrity One Planning Services Pty Ltd as a Corporate Authorised Representative No. 315000 of Integrity Financial Planners Pty Ltd ABN 71 069 537 855 AFSL 225051. Integrity One Planning Services Pty Ltd and Integrity One Accounting and Business Advisory Services Pty Ltd are not liable for any financial loss resulting from decisions made based on this information. Please consult your adviser, finance specialist, broker, and/or accountant before making decisions using this information.

Goals are important in keeping us motivated to get to where we want to be. When it comes to property, your goal may be to get a foot on the ladder, grow your portfolio or secure your dream home.

The key to achieving your goals is identifying what they are – making them quantifiable and then putting a plan in place to reach them. Now is a great time to think about your property goals for 2023.

Entering the property market as a first home buyer can be both exciting and daunting, and it can be hard to save for the initial deposit. However, the government has introduced a number of grants that could help eligible first home buyers.

Whether you’re new to investing in property or continuing to build on your portfolio, your goals need to take into account your investment strategy – are you wanting to take advantage of negative gearing to generate wealth, ‘rentvesting’ to get onto the property ladder, or are you investing in property to create a passive income stream to help fund retirement.

If buying a larger home is on the cards, these properties are typically more expensive; therefore, you’ll need to factor this in when goal setting and understand how much this will impact your budget – will you need to make any sacrifices to your current lifestyle to service the loan?

There are many different approaches when it comes to goal setting. You’ve likely heard of SMART goals, which are Specific, Measurable, Achievable, Relevant and Time-Bound.

Vague or general goals like “save a deposit for a house” are harder to achieve and often don’t come to fruition as there is no plan behind them. Using the SMART goals framework forces you to be specific about what you want, have a way to measure and track your progress, ensure that your goal is achievable and relevant to your needs and that it has a timeframe associated with the goal.

Specific – Exactly what do you want to achieve?

Measurable – How will you know when you have achieved it?

Achievable – What will you do to reach your goal?

Relevant – How does your goal align with your key objectives?

Time-bound – When will you have achieved your goal?

You can use the SMART framework with each of your goals and then break down the steps required to meet each goal.

As you begin setting your property goals, consider how these goals will influence your family’s day-to-day life and your overall personal goals and values, as this can have a big impact on your decision making.

If you’re a first home buyer, you need to identify how much you will be able to borrow, as this will determine how much deposit you will need and whether you’re eligible for any home owner grants. You should also consider other costs that may be associated with purchasing a home, for example, you will need a conveyancer/solicitor as well as any building or pest inspections that may be required.

Plus, there is the additional cost of furnishing the home, so it’s important that you do your homework to understand exactly how much your initial outlay will be.

For the investor, you might be working towards a specific amount in passive income you want to generate, or you may want to own a set number of investment properties by a certain age.

If you have equity in your current home, you could use that to purchase an investment property, or another consideration is to buy a property off the plan, as these properties can sometimes be less expensive than an established home.

It’s also important to factor in the potential rental returns in the area you are looking to buy. Investment properties will also require regular maintenance, so having an emergency fund could be a good idea.

The upgrader may have a set floorplan in mind or be looking to move to a new area. Again, you’ll need to factor in how you are going to service the loan if it is higher than your current mortgage repayments, and other costs associated with the upgrade. You’ll more than likely need to purchase additional or different furniture to fill a larger home.

Where we can sometimes lose our way with our goals is by setting a framework that is unrealistic and this is where they may get discarded. If you’ve set goals that are unachievable – especially when it comes to budgeting – it can be challenging to see them through. Perhaps you decided to save for a deposit but are now finding the lifestyle sacrifices are too much. This is where leaning on your support network as a reminder as to your ‘why’ can be helpful.

Visualising your goals can also be powerful. While this may sound ‘woo’, imagining yourself in your property – whether it be your first home, getting the keys to your investment property or moving into a bigger house – can keep you motivated. Tracking your progress regularly is also a smart idea, as this will not only keep you working towards your property goal, but it can also help you recognise the small wins and where you might need to adjust your goals.

Accountability is also important, which is why we often share our goals with others so that we can feel more motivated to reach them.

If you are considering purchasing a property in 2023, we are here to help so contact us today.

Suite 2, 1 Railway Crescent

Croydon, Victoria 3136

Telephone : 03 9723 0522

Email: integrityone@iplan.com.au

Stay up to date with what’s happened in the Australian economy and markets over the past month.

As 2022 drew to a close, investors remained focused on inflation, interest rates and recession worries.

The ASX200 index declined in December after two months of gains, ending a challenging year showing an overall loss through 2022 of over 7%.

Click here for our January update video.

Please get in touch on 03 9723 0522 if you’d like assistance with your personal financial situation.

Suite 2, 1 Railway Crescent

Croydon, Victoria 3136

Email: integrityone@iplan.com.au

Telephone : 03 9723 0522

After months of research, weekends spent attending inspections and auctions, finding the perfect home, at the right price brings a sense of relief and excitement. But what if you haven’t sold your current house yet?

Finding your next home before settling your existing property’s sale is a common predicament, with many using bridging finance as a convenient way to fund their crossover period.

Fortunately, most lenders now offer this type of finance and there are lots of options available. However, there are also some important things to consider before adding a bridging loan to your mortgage. Let’s go over the basics to help you decide if it could work for you.

Using a bridging loan can help ensure you don’t miss out on your new dream home or accept a lower offer as you rush the sale of your current one. And if you can buy before selling, it also means you won’t have to waste money renting while you look for your next home.

You can also use bridging finance to fund renovations to prepare your property for sale or to cover costs for things like moving and medical, legal or general living expenses. In all these cases, you must have a property already on the market and expected to sell within 6 to 12 months.

Lenders have a range of ways they link bridging and home loans, but they are basically an advance on the sale of your existing home. Essentially, when you buy your next property, you start paying your bridging loan interest and new mortgage repayments.

We can discuss the setup of your finance with lenders to suit your circumstances. This may include deferring bridging interest payments until you settle the sale of your current home. It may also be possible to negotiate the same or different interest rates for your bridging and home loans depending on whether you want your ongoing mortgage to be a fixed or variable rate.

When deciding whether bridging finance will work for you, you may need to include paying your existing mortgage until the property is sold in your calculations.

Bridging loans can be either closed or open. If you have agreed a sale and settlement date, you can select a closed bridging loan that ends just after this date. If you haven’t found a buyer, an open bridging loan usually has a term of 6 or 12 months.

With both, it’s usual for a lender to ask for proof that your current property is already on the market. Many lenders charge a higher interest rate if you don’t sell your property by the agreed date, so it pays to ensure both sales go through within the agreed timeframe. And just like regular mortgages, they can also force the sale of your existing property if you fail to meet repayments.

Lenders vary in the types of properties they will lend against. Some won’t lend to companies or for strata titles, for example. They also often require higher owner equity in both the old and new homes. And like ordinary mortgages, the amount of equity you have will affect your interest rate.

It’s common, but not essential, to use the same lender for your bridging finance and new property mortgage. Lenders use a complicated formula to decide if you can afford to repay these combined loans. This is called your ‘peak debt’.

Say your new home loan is for $800,000 and your bridging loan is for $200,000. That means your peak debt is $1 million, plus interest for the duration of your bridging loan term. If you then pay $400,000 of equity from the sale of your old home into your loans, your ongoing balance reduces to $600,000. Which will be your mortgage amount going forward.

With rising interest rates and property price fluctuations, it’s more important than ever to get your changing home calculations right.

If you’d like to know more, please get in touch as soon as you’re thinking of selling. We can calculate what you can afford to buy and go through your lender and loan options to find a solution that works for you

Suite 2, 1 Railway Crescent

Croydon, Victoria 3136

Telephone : 03 9723 0522

Email: integrityone@iplan.com.au

All Rights Reserved 2016 Copyright Integrity one