Suite 2, 1 Railway Crescent

Croydon, Victoria 3136

Email: integrityone@iplan.com.au

Telephone : 03 9723 0522

Your Complete Financial Solution

It has been a wild ride for the Australian dollar since the Covid-19 pandemic struck and that could mean good news or bad news for your investment portfolio.

In March 2020 the Aussie dipped below US58 cents for the first time in a decade. Since then, a high of just over US77 cents in 2021 has been followed by a rollercoaster ride, mostly downhill.

Given any currency’s susceptibility to changing economic conditions both at home and overseas, the Aussie has had quite a bit to deal with lately.

Rising interest rates can boost the Australian dollar by making us more attractive for foreign investors, providing our rates are rising ahead of the US and others.

If foreign investors buy more Australian assets because they can get a bigger return on their investment, more money flows into Australia which increases demand for Australian dollars. And if investors hold more Australian assets than overseas ones, less money leaves the country, decreasing supply. So, increased demand and decreased supply see the Australian dollar rise.

While the Reserve Bank of Australia (RBA) has increased rates by 4% in Australia since May last year as it battles to get inflation under control, rates have also been rising in the US.

The US Federal Reserve has undertaken its most aggressive rate-rising cycle in 40 years with rates now at a 22-year high and signs of further increases likely. This has put pressure on the Australian dollar, narrowing the difference between the US and Australian rates, meaning foreign investors will look for better returns elsewhere.

The value of the Australian dollar is also affected by changes in economic conditions as well as rises and falls in other financial markets. For example, in August news that the unemployment rate had increased slightly and an easing in wage price growth led to speculation that the RBA would put a hold on rates, putting a dampener on the Aussie.

Also affecting the dollar was a decline in US share markets in August, confirming the typical pattern of the Australian dollar falling when prices in equity markets drop.

Meanwhile, the performance of China’s economy plays a significant part in Australian dollar movements. China is currently battling soaring unemployment, particularly among young people, falling land prices and a housing crisis, among other ills.

There are advantages and disadvantages of a falling Australian dollar. On the plus side, our exports will be more competitive because our customers will pay less for our goods and services compared with those produced overseas. Conversely, imported goods will be relatively more expensive.

There could also be an increase in tourism – the cost of travel in Australia will be cheaper for those coming from overseas. Unfortunately, those planning an overseas trip will need to find a significantly greater pile of Australian dollars to pay for airfares, accommodation and shopping.

For investors, it is a useful exercise to review the currency’s effect on your portfolio.

For example, if you’re invested in Australian companies that rely on overseas earnings, look at how they handle their exposure to the currency risk. A lower dollar is good news for those with overseas operations and those that export goods. On the other hand, those that need to buy in components or products from overseas may suffer.

In any case, have a chat to us to look at the best way forward in these uncertain times.

Suite 2, 1 Railway Crescent

Croydon, Victoria 3136

Email: integrityone@iplan.com.au

Telephone : 03 9723 0522

A mortgage is a long-term commitment, one in which many people enter with a ‘set and forget’ mentality. Most loans are around 30 years – a long time in which many things can change, not just in your personal circumstances but in the financial world, seeing the introduction of new loan products and fluctuations in interest rates.

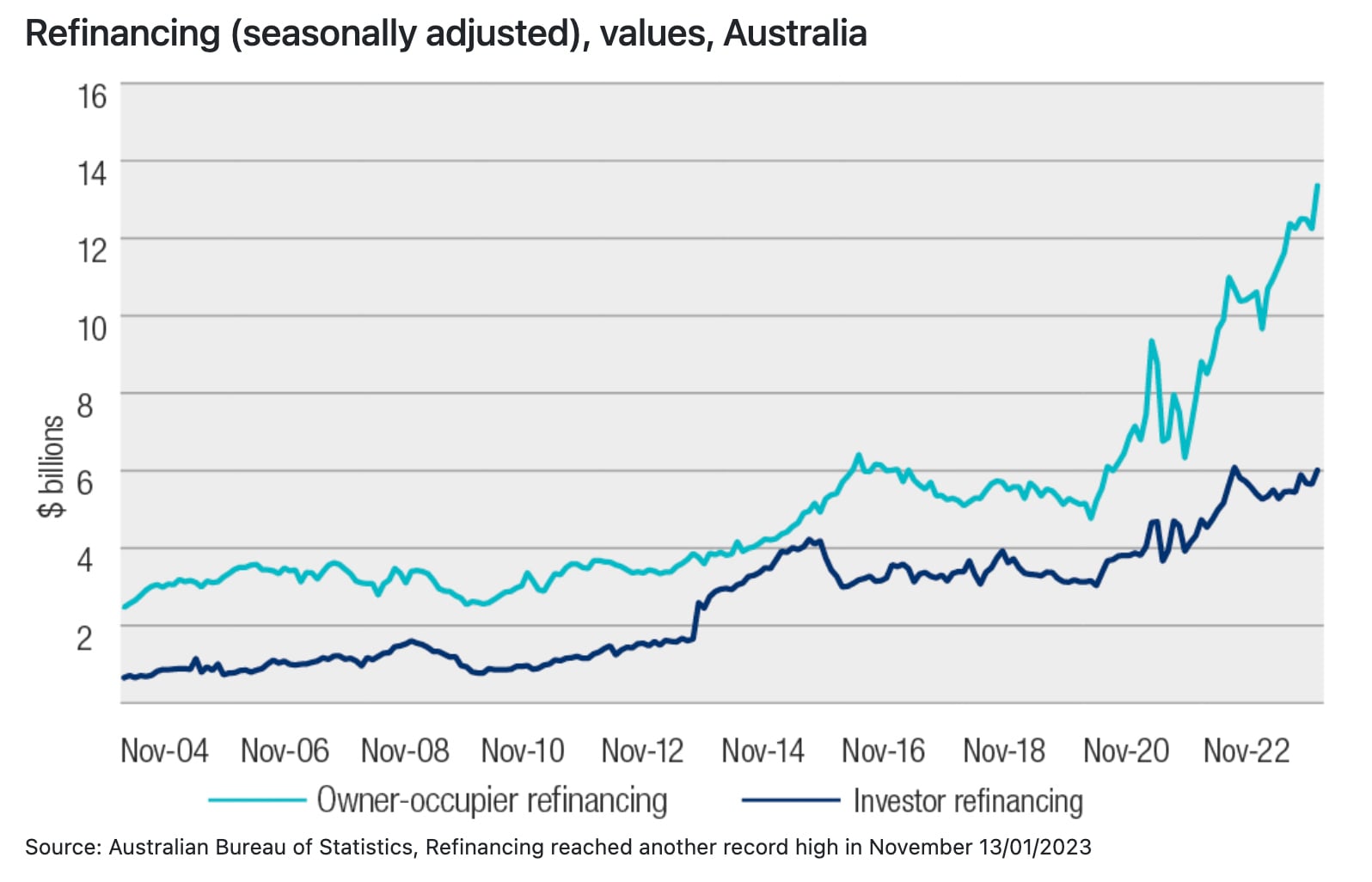

If you haven’t reviewed your loan for a while, now is a good time to consider whether it still suits your circumstances or whether you’re better off making some changes. It’s what many Aussies are doing, with the ABS reporting the value of owner-occupier refinancing of $13.4 billion last November.i

It is a good idea to review your loan annually and there’s no better time than the present.

While this can seem like an arduous task, it doesn’t need to be complicated. Read back over your loan’s terms as a starting point. To ensure you’re receiving the best interest rate for your loan – and whether your loan is still fit for purpose – ask yourself a few things:

Knowing where you are standing financially can help you then decide whether it’s worth refinancing and chasing a better interest rate, or whether your existing mortgage is still working for you.

There’s not just one type of refinancing, but many different types of refinance loans, including:

This is where you replace your loan with a new loan that is the same amount, but at a changed interest rate and/or term. This is the most common refinancing option and often what people think of when it comes to refinancing.

A cash-out refinance loan enables you to access the equity in your home by taking out a new loan with a higher loan balance than your existing loan.

A cash-in refinance loan has you lowering your overall loan amount by contributing a lump sum – this is done by taking out a new loan less than your old loan, paying out the difference to close your old loan.

As opposed to a variable rate, a fixed loan guarantees a locked interest rate for a period of time (usually between 1-5 years). This is a popular option during a time of rate hikes. However, it can come with drawbacks such as not being able to take advantage of any rate cuts.

As its name suggests, a split loan allows you to split your loan into multiple parts with different interest rates and terms. For instance, you could have part of your loan at a variable interest rate and another part as a variable rate.

This is where you combine all your various debts into the one debt (including credit cards, car loans, etc) and therefore one repayment. This can make your debts easier to manage but can mean your short terms debts are stretched over the life of your new home loan.

While (generally speaking) the goal of refinancing is to save money, there are a few considerations to be aware of, so you don’t end up paying more in your quest to save.

Refinancing can impact your credit rating, causing it to drop. However, it’s worth keeping in mind that this dip is short-term and shouldn’t have too big an effect on your credit score in the future.

Another thing to be mindful of is that you may need to pay Lender Mortgage Insurance (LMI) again. As LMI protects lenders, your original LMI payment won’t cover a new lender, which is why you can expect to pay this again. For most borrowers, you’ll need 20% of the property’s current value to avoid paying LMI again, keep in mind the value of your property may have changed since you first took out your loan. You might also need to pay LMI even if you stick with the same lender, but you’ll likely be given a discount.

There are also costs related to refinancing, such as application fees, discharge/break fees and valuation fees. Some lenders waive these costs or offer a discount, so be sure to ask what you will be expected to pay and see what you can negotiate.

You may also find that your bid for refinancing is rejected if you have accumulated too much debt or if your living expenses are now too high. Changes to your loan could also stretch out the repayment period, leading you to pay more in the long run.

Whether you decide to refinance or stick with your current loan, by refamiliarising yourself with the conditions of your loan and assessing your financial situation, you’ll be better placed than if you ‘set and forget’.

Set a reminder to do this once a year – it can be easier to remember come the end of the financial year or the start or end of the calendar year.

You don’t have to go through the process alone. Give us a call on 039723 0522 to discuss your existing loan and circumstances and to chat about your future financial goals.

Stay up to date with what’s happened in Australian markets over the past month.

While the price of most goods and services continues to rise, the good news is the rate of increase is continuing to slow.

As a result, the markets are beginning to breathe a sigh of relief.

The ASX rallied to close the month on a positive note due to a combination of stronger than expected growth data, better than expected earnings and lower inflation.

Click here for our August update video.

Please get in touch on 03 9723 0522 if you’d like assistance with your personal financial situation.

Suite 2, 1 Railway Crescent

Croydon, Victoria 3136

Email: integrityone@iplan.com.au

Telephone : 03 9723 0522

At present, and over the coming months, there will be road and railway works taking place in the vicinity of our Croydon office. These works include level crossing removal and replacement of the Croydon railway station and may result in some disruptions and detours from time to time.

But rest assured, we will be open, and you will be able to visit us!

We will let you know of any known impacts when appointment bookings are made, but it may be prudent to call us on the day and check the state of play. Nevertheless, it would be a good idea to allow a little more travel time when visiting us over the next 6 months.

If you’d like more detailed information regarding the works they can be found here.

Or via this useful interactive map.

Thank you for your patience!

Suite 2, 1 Railway Crescent

Croydon, Victoria 3136

Email: integrityone@iplan.com.au

Telephone : 03 9723 0522

As the inflation rate begins to ease, with consumer inflation slowing to a 13 month low in May, many commentators expressed hope that further interest rate rises may be kept in check.

That led to a slight improvement in investor outlook for stocks at the end of June.

The S&P/ASX 200 closed the month at about the same level as in May but, over the financial year, it’s risen more than 10%.

Click here for our July update video.

Please get in touch on 03 9723 0522 if you’d like assistance with your personal financial situation.

Suite 2, 1 Railway Crescent

Croydon, Victoria 3136

Email: integrityone@iplan.com.au

Telephone : 03 9723 0522

Everyone loves a bargain, but as cost-of-living increases continue to put pressure on budgets, tracking down a freebie or two can also take some pressure off.

Getting things for free that you would otherwise have had to fork out for, also means you can save while still having some room to splash some cash around for the fun stuff.

Aside from the obvious cost savings of a freebie, it’s a clever way to test things out before you’ve committed to buying something that you may not want or need in the long run. It’s awful to spend money on something, only to find out that you’ve wasted your hard-earned cash. Not to mention the environmental benefits of using goods that might otherwise be going into landfill.

There are loads of ‘buy nothing’ groups and sites such as Nextdoor or Freecycle that have sprung up to give away things that people don’t want anymore including furniture, appliances, moving boxes and plants.

‘Buy nothing’ groups also sometimes organise clothing swaps. The clothes you don’t wear any more might be just what someone else is looking for. Keep your eye out for any in your area or even organise your own with a group of friends.

If you just need an item for a short period of time it might make sense to borrow it. Online libraries make it easy to exchange goods on a temporary basis at no cost. It’s a great choice if you just need something for a short space of time – like tools for a project or a tent to take off camping for the weekend. A site worth checking out is Melbourne’s The Sharing Shed.

Even if you are doing your best to not spend, there are times when you can’t avoid pulling out the credit card. However, your credit card can give you access to a host of freebies like hotel stays, flights, gift cards and appliances via rewards programs.

Just be conscious that finding the right credit card means considering interest and fees. No rewards program is worth paying a lot of interest or being stuck with expensive fees. And not all rewards programs are created equal, some are more generous than others so be sure to read the fine print.

Using your credit card for as much as possible of your eligible spending will help maximise the points you can earn, but just make sure you can manage the repayments on the card, so you are not incurring late fees.

You could also look at rewards programs with your favourite businesses. Many shops and restaurants offer special perks for members’ birthdays or for regular customers, offering freebies such as food, shipping, gift cards, merchandise and movie tickets.

Of course, there are other ways to score freebies from businesses, but they usually want something in return.

Many businesses offer discounts, vouchers and free products or services in exchange for supplying reviews on sites like The Champagne Mile. As well as the attraction of free stuff there is also a feel-good factor that you are helping the businesses you are reviewing.

It’s also common for businesses to offer free trials to introduce you to their company or products, and this can be a fantastic way to try something for free for a brief period. Just be aware that you’ll need to give them your credit card to access these so it’s important to keep track of the cancellation date and cancel at the end of the trial to avoid incurring costs. Be careful though – scammers often dangle an enticing freebie to get you to give them your credit card details so verify any offer to make sure you are not being swindled.

Once you start seeking out freebies you’ll find a lot more – and you won’t just be getting free stuff, you’ll be freeing up savings for the important, big-ticket items.

Suite 2, 1 Railway Crescent

Croydon, Victoria 3136

Email: integrityone@iplan.com.au

Telephone : 03 9723 0522

All Rights Reserved 2016 Copyright Integrity one